- Review

- Open access

- Published:

A bibliometric analysis of socially responsible investment sukuk literature

Asian Journal of Sustainability and Social Responsibility volume 5, Article number: 7 (2020)

Abstract

Despite the impressive growth of socially responsible investment (SRI) Sukuk (Islamic bond) over the last five years, a handful of comprehensive research is documented in literature. Hence, the aim of this study is to systematically explore and cluster the SRI Sukuk literature to offer comprehensive guidelines for future research. A total of 232 peer reviewed papers from Web of Science database were considered for bibliometric analysis (using VOSviewer software) which are published over the period of 1970-May 2019. This analysis shows SRI Sukuk literature mainly falls in three research clusters: (1) nature of SRI Sukuk, (2) competitiveness of SRI Sukuk, and (3) determinants of SRI Sukuk. However, very few studies have explored the determinants of SRI Sukuk investment. The literature also indicates that, SRI Sukuk research are highly collaborated between Malaysia, Australia, and the USA yet the number is trifling. Thus, exploring motivational factors of SRI Sukuk investment and its impact on the nation’s economic development in a cross-country setting would be worthwhile researching.

Introduction

In literature, SRI has been referred as socially responsible investment, sustainable and responsible investment, and sustainable, responsible, and impactful investment (Securities Commission Malaysia 2017). Whereas SRI Sukuk is defined as Islamic bond that follows Islamic Shariah principles for financing activities (Alam et al. 2013; Wilson 2008). It is also named as Islamic Sukuk, green bond, Islamic debt instrument, etc. Islamic finance and socially responsible investment (SRI) have experienced rapid growth over the last two decades. During the last decade, both of their growth in volume are significantly higher compared to conventional finance. The total volume of Islamic financial investment has grown 15%–20% a year, with Islamic financial assets exceeding US$1 t in recent years. SRI funds have also grown by 30% since 2005, with a total volume of assets exceeding US$3 t (Bennett and Iqbal 2013). By the end of 2018, the total value of SRI worldwide stood approximately US $30,683b in which Europe has the largest value of US $14,075b invested internationally followed by the US with a value of US $11,995 (Global Sustainable Investment Alliance 2019). Since 2008, The World Bank has issued “World Bank Green Bond” which attracts investors who concern about climate change and want to protect the environment. The fund generated from this bond has been used to run low carbon development projects (Reichelt 2010). As of June 2015, the World Bank has issued over 100 green bond papers valued at US$8.5b.The growth reveals that investors have started to consider social and environmental issues and there is an increase in awareness among investors to protect their ethical values.

Due to the significance of SRI and SRI Sukuk in financial investment, academics and researchers have devoted their effort to investigate this phenomenon. During the last three decades, the study related to green investment or SRI has become a cornerstone of research among scholars in the area of sustainable financial investment. Based on the personal search in Web of Science (WoS) database using the keyword – “socially responsible investment” on 10 June 2019, it was found that the number of publications on SRI is around 800, whereas using the keyword – “Islamic Sukuk”, only about 140 publications appeared. Thus, it indicates that the number of SRI research is greater compared to the research on SRI Sukuk. In a review of literature in the past thirty-five years, Viviers and Eccles (2012) report that financial performance, trust and legal aspect of SRI studied more in the past research. Junkus and Berry (2015) also highlight a similar review of SRI research. Besides, systematic literature review (Viviers and Eccles 2012) and meta-analysis of SRI performance (Kim 2019) have been conducted on SRI. However, despite having impressive growth of the Sukuk market in recent time (Haque and Buriev 2017; Razak 2019; Asutay and Hakim 2018; Maghyereh and Awartani 2016), the research on SRI Sukuk is less in volume. Precisely, the study related to the overall overview of SRI Sukuk is still in dearth. Although Hasan et al. (2019) critically analyse the past literature on Islamic bonds, their investigation portrays findings related to Sukuk risks and offers some techniques to minimize those risks. Likewise, Ibrahim (2015); Zulkhibri (2015) also review past literature on Sukuk instruments analysing the current literature about the role of Sukuk in the financial market and economic development.

Despite these critical reviews of literature on SRI Sukuk, a more systematic approach using bibliometric analytics of literature is still appealing. Hence, some conclusive understanding to advance this area of research is timely. In fact, to the best of our knowledge, there is no study conducted which analyse the SRI Sukuk literature based on bibliometric metrics data except Paltrinieri et al. (2019). Moreover, Paltrinieri et al. (2019) Sukuk work is limited by literature review, while they used only four simple keywords as a literature search techniques. Bibliometric analysis refers to the assessment of bibliographic information of scientific research publications following statistical methods using qualitative and quantitative indices such as bibliographic mapping, profiling of publications, clustering, visualizing the published works (De Bakker et al. 2005; van Eck and Waltman 2014). Moreover, this analysis offers a useful indication to the expert to explore dominant interrelationships in the specific literature (Fellnhofer 2019; van Eck et al. 2010a, 2010b) as well as the impact of researchers, topics, journals, countries, institutions etc. (Krauskopf 2018). Therefore, the current study of analysing SRI Sukuk literature using bibliometric analytical techniques will not only provide an overall overview of the Islamic bond literature for the scholars but also be useful for the experts to evaluate the impact of SRI Sukuk in policymaking. This study provides the general bibliometric overview of the Islamic Sukuk literature which includes, publication trend according to journal, citation trends, prominent journal, authors, institutions, countries, highest cited publication in the study area. Besides, visualization co-authorship of organizations and country, co-occurrence of keywords and bibliometric coupling analysis are carried out to visualize the interrelationships and clustering of scholarly works on the study area. It portrays avenues for future research resulting from clustering scheme constituted by bibliometric coupling techniques. Thus, the study’s aim is to mapping the interrelationships of connected contributors and contributions to visualize the dominant associations and recommend the possibilities of future research in the area of SRI Sukuk research.

Concept of SRI Sukuk

According to Shariah scholars and stakeholders, structuring a new Sukuk is an in-depth process which guarantee that fundraiser will not finance any unethical businesses and devoid of harmful activities. Hence, it is considered that Sukuk has built-in characteristics of SRI which can attract conventional socially responsible investors. Sukuk guarantees that the funds raised through Sukuk will be used in Shariah-compliant investment and confirms the certainty of the investments. The Sukuk funds can be used for a specific development project such as renewable energy project, vaccination program, educational project or low-cost housing program which will be appealing to SRI investors whose ethics and values match with the welfare (Bennett and Iqbal 2013; (Haque and Buriev 2017; Razak 2019; Asutay and Hakim 2018; Maghyereh and Awartani 2016)). Refer to Godlewski et al. (2013), the payments on Sukuk are yielded from an underlying asset that is alike to a conventional bond. Therefore, conventional investors will be able to value their Sukuk investment with a similar methodology used in conventional bond and existing fixed income cash flows. Most of the SRI products are considered as an equity investment rather than a fixed income investment. Due to fixed income characters along with equity product, there is a lack of opportunities for SRI investors to select their portfolio which fulfils their SRI criteria. As Sukuk is comparable to conventional fixed income cash flows, the growth of SRI Sukuk can attract SRI investors in Islamic financial products.

The governments of different countries took many initiatives to support the growth and awareness of SRI Sukuk. In 2012, for example, the Climate Bonds Initiative (CBI) in cooperation with the clean energy business council of the Middle East and North Africa (MENA) and Dubai-based Gulf Bond and Sukuk Association (GBSA) established the green Sukuk working group to promote the idea of green Sukuk which meets a low-carbon criterion. Malaysia has recently launched the SRI Sukuk Ihsan by Khasanah Nasional Berhad (Khazanah). The Sukuk is structured to offer a new method of fund “trust schools” through the capital market. An SPV, Ihsan Sukuk Bhd., was established by Khazanah in early 2015 to issue a ringgit-denominated SRI Sukuk program worth RM1b. This is the first SRI Sukuk approved under SC’s SRI Framework and was given AAA rating by RAM Rating Services Berhad (Khazanah Nasional Berhad, 2015). The first issuance was on 18th June 2015 and managed to raise funds worth of RM100m with a periodic distribution rate of 4.3% per annum throughout seven-year tenure (The Star Online, 2015). The proceeds of the Sukuk are to be utilized for funding the establishment of 20 School under Yayasan Amir’s Trust School Program, a non-profit organization established by Khazanah with the purpose to improve the quality of education in Malaysian public schools through Public-Private partnership with the Malaysian ministry of education. The second issuance was announced at the end of July 2017 and has raised RM100m by the seven-year SRI Sukuk issued by a Malaysian-incorporated independent Special Purpose Vehicle, Ihsan Sukuk Bhd.

Methodology

To fulfil the research objective, this paper adopted systematic mapping study (SMS) approach proposed by Fellnhofer (2019), and Paltrinieri et al. (2019). In SMS, bibliometric coupling, co-citation and direct citation analyses are regarded as the most reliable and accurate technique in mapping the study literature which is capable of clustering and visualizing the networks of interconnected contributions and contributors (Boyack and Klavans 2010; Fellnhofer 2019). Thus, this study also followed similar analytical techniques as mentioned in Fellnhofer (2019).

Following the SMS approach, this study extracts the bibliometric data related to SRI Sukuk literature from Web of Science (WoS) database. As WoS is acknowledged as the oldest citation database with wider coverage of scholarly publication (Mascarenhas et al. 2018; Rey-Martí et al. 2016), the bibliographic information of SRI Sukuk literature is extracted from this database only. However, to ensure the quality of the data, the retrieved dataset was cross-checked with the Scopus database.

Literature search commenced at the beginning of May 2019 in WoS database to look for all possible publications without limiting the timespan (Mascarenhas et al. 2018; Sarker et al. 2019). Using the keywords/terms - (“SRI Sukuk”) OR (“Islamic Sukuk”) OR (“Green Sukuk”) OR (“Sukuk bond*”) OR (“Islamic bond*”) OR (“Green bond*”) OR (“Socially Responsible Investment Sukuk”) OR (“Socially Responsible Bond*”) OR (“Sukuk”) in either title or abstract, a total of 258 publications were emerged. The keywords were chosen after an initial search on Google scholar and looking at the possible variations of terms used in the Islamic Sukuk related publications. Moreover, all the authors validated the selected terms to be used for extracting the study-related publications. During this process, 7 publications were initially discarded as these were book reviews and editorial materials. Looking at the time span in WoS database search, it was found that another 4 documents were published before 2000 which are not relevant to the study objective. In fact, the first document related to Sukuk bond was published in 2003 by the “Accounting and Auditing Organization for Islamic Financial Institutions” (Zulkhibri 2015). Hence, in the second phase of the search, 247 publications were extracted which were published between 2000 and 2019. Following this extracted collection of SRI Sukuk literature, abstract of each publication was reviewed by the authors to check the relevant and quality of the publications. Of these publications, 15 documents were found related to Mathematics, Geography, Nanoscience, Nanotechnology, Biochemistry etc., hence discarded from the list. Finally, a total of 232 documents emerged through this process which was retained for bibliometric analysis. The search protocol is presented in Fig. 1. After selecting the number of documents from the WoS database, the quality of datasets was checked following a similar protocol (i.e. in Fig. 1) in Scopus and 235 publications were appeared. Hence it is assumed that the number of documents retained from the WoS database is consistent with another widely accepted source namely Scopus.

In the next step, bibliometric data were downloaded from the WoS database and analysed using MS Excel and VOSviewer software. Specifically, a general overview of the bibliography information is analysed using MS Excel and visualizing dominant networks and cluster were formed by VOSviewer software (Paltrinieri et al. 2019; Fellnhofer 2019; van Eck and Waltman 2014). Due to the scaling and algorithm techniques employed in this tools, VOSviewer is acknowledged as a more powerful tool compared to others for bibliometric analysis of publications and literature (van Eck et al. 2010a, 2010b; Waltman and van Eck 2013). VOSviewer identifies strongly connected publications based on reference cited in two documents provided that interconnected reference cited in two publications is considered as a common school of thought and positioned closely on the visual map (van Eck and Waltman 2014; van Eck et al. 2010a, 2010b). Thus, those publications were not linked to the SRI Sukuk literature were discarded during mapping analysis. This process yielded 53 publications and was initially grouped into 9 clusters with the default setting in VOSviewer. Among these 9 clusters, cluster 1 comprised of 9 documents, cluster 2 comprised of 7 documents, cluster 3 comprised of 6 documents, cluster 4 comprised of 6 documents, cluster 5 comprised of 5 documents, cluster 6 comprised only of 4 documents, cluster 7 comprised only of 2 documents, cluster 8 comprised only of 2 documents, cluster 9 comprised only of 2 documents. Due to a fewer number of documents in the derived cluster, bibliographic coupling analysis was run again merging the small clusters which re-produced three clusters (Fellnhofer 2019). Finally, out of these 3 clusters, cluster 1 contained 19 documents, cluster 2 contained 15 documents, and cluster 3 contained 9 documents.

The derived clusters using bibliometric mapping were then analysed qualitatively (Fellnhofer 2019; van Eck and Waltman 2009). The theme of each cluster is identified by evaluating the titles, abstracts and keywords of each publication within the cluster. After that, the contents in each cluster were analysed based on cited references, prominent publications, authors, journals, and organizations (Fellnhofer 2019). Following this approach 232 publications on SRI Sukuk were analysed and interpreted. Table 1 highlights the bibliometric analysis protocol followed in this study.

Findings of bibliometric analysis

Number of publications and citation trends in the last ten years

From the derived data of WoS, it was found that over the last ten years, the number of publications and citations are increasing gradually. The highest number of articles published in 2018 (60 documents) along with the number of citations (205 citations). There were 19 documents published in 2012 which could be considered as the interesting progress of Sukuk research among the scholars compared to the beginning in 2009. Overall, it can be assumed that the research interest in the area of SRI Sukuk in growing among the academics and researcher in this study area (Fig. 2).

Sources of publications

Due to the emergent of SRI Sukuk research, documents published in the journals are not good in numbers. The highest number of documents published in the book titled “Islamic Debt Market for Sukuk Securities: The Theory and Practice of Profit Sharing Investment” (only 5.60%) and the journal titled “Pacific-Basin Finance Journal” (5.60%). Among others, “Journal of Islamic Accounting and Business Research” (4.74%), “International Journal of Islamic and Middle Eastern Finance and Management” (3.45%), and “Research in International Business and Finance” (3.45%) have published the majority of the articles related to Sukuk instruments. Alongside, few publications were also presented and published in conference proceedings “IOP Conference Series Earth and Environmental Science” and “Procedia Social and Behavioral Sciences”. Interestingly, Russian Academy of Sciences (RAS) also published few articles in the journal - “Mirovaya Ekonomika I Mezhdunarodnye Otnosheniya” indicates that the subject matter is getting widespread attention in many areas including general finance and Islamic finance. It can also be remarked that although the number is negligible (only 1.72%), some top-ranked journals (i.e., “Review of Financial Economics”, “Managerial Finance” “Journal of International Financial Markets Institutions Money”, “Borsa Istanbul Review”) also published SRI Sukuk related articles which show the interest and scope of publication opportunity for the related stakes. Figure 3 highlights the percentage of SRI Sukuk publication appeared in the journals, conference proceedings and book.

General bibliometric overview of SRI Sukuk research publications

Given the bibliometric data of Sukuk publication, majority of the publications were entitled in the area of Business Finance (57.76%) followed by Economics (23.28%), Business (8.19%), and Management (8.19%). Although some articles were published green sustainable science, environmental science, and regional urban planning, the origin of Sukuk research is rooted in the area of Finance, Economics, and Business while few are related to religion yet in the area of Islamic Finance.

Among the scholars publishing in this area of research, Naifar, N. has the highest number of publications (10), followed by Ariff, M. (9), Hassan, M. K. (6), Hammoudeh, S. (5), and Mohamad, S. (5). Naifar, N. is a finance faculty member at Al Imam Muhammad Ibn Saud Islamic University, Saudi Arabia and Ariff, M. is a Finance professor at Bond University, Australia. Among others, Ahmad, N.; Aloui, C.; Azmat, S.; and Bacha, O. I. are also a well-known researcher in this research area.

Data also reveals that International Islamic University Malaysia (IIUM) entitled 16 research publications which are the highest number among the academic institutions. Besides, 13 documents were published in affiliation with Al Imam Muhammad Ibn Saud Islamic University (IMSIU), Saudi Arabia; Universiti Technology Mara (UiTM), Malaysia [13]; Monash University, Australia [10]; Universiti Sains Islam Malaysia (USIM), Malaysia [8] which signposts that majority of SRI Sukuk related publications are entitled to Asian university specifically Malaysia. Among the country-specific publication, authors in affiliation with Malaysia have published about 33% SRI Sukuk research. It could be due to the availability of research funding and scope of Sukuk is more prevalent in Malaysia, Malaysian universities are encouraging to carry out Sukuk research among the academic scholars. Also, about 16% publication is affiliated with the USA, Saudi Arabia (about 12%), Australia (about 10%), England (about 8%) respectively. Hence, it is assumed that although Sukuk research is leading by Malaysia, the research contributions in this area from American and European countries are also notable. Table 2 summarises the descriptive statistics of general bibliometric information on SRI Sukuk research.

Generally, the number of citations of an article is a well-known bibliometric indicator which signposts the quality of the publication (Fellnhofer 2019; Rey-Martí et al. 2016). Hence, this study also collected the number of direct citations of Sukuk related publications and demonstrates the top ten cited publication and authors in Table 3. Results show that with 46 citations the articles entitled “Sukuk vs. conventional bonds: A stock market perspective” was the top publication in the area of Sukuk research authored by Godlewski et al. (2013). Among others, the publications are written by Aloui et al. (2015a) with the contribution “Co-movement between sharia stocks and Sukuk in the GCC markets: A time-frequency analysis” has received the second highest citation of 28 which investigated the interdependency between shariah stock and Sukuk in the GCC market. Results in Aloui et al. (2015a) suggest, there is a strong positive tie between sharia stocks and Sukuk. Likewise, articles written by Naifar (2016) [23 citations], el Alaoui et al. (2015) [22 citations], Aloui et al. (2015b) [22 citations], Ibrahim (2015) [17 citations], Ariff et al. (2012) [15 citations], Maghyereh and Awartani (2016) [13 citations], Azmat et al. (2014a) [13 citations], and Mohamed et al. (2015) [12 citations] respectively are the prominent contributors in the area of Islamic Sukuk research.

Bibliographic mapping and clusters

Using the VOSviewer, visualized maps were created which demonstrates the interrelationships of underlying issues among the SRI Sukuk publications. The close distance among the publications, authors, topics etc. indicates the strong ties which share a common theme in regard to analytical metrics (Fellnhofer 2019; van Eck and Waltman 2014). The results of the bibliographic mapping of SRI Sukuk literature are discussed as follows.

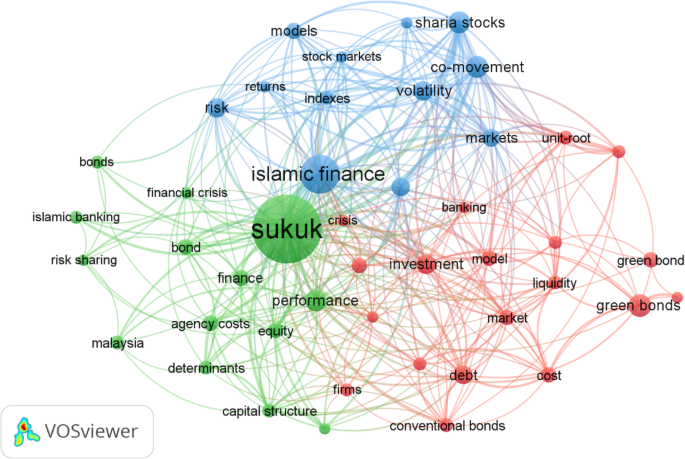

Co-occurrence of keywords

Using the VOSviewer co-occurrence of keywords were analysed. There were 882 keywords emerged with this process. The size of the node represents the magnitude of keywords occurrence (Krauskopf 2018; van Eck and Waltman 2014) in the titles and abstracts of 232 publications related to SRI Sukuk. Result in Fig. 4 demonstrates that the word “Sukuk” was the most mentioned keywords conjunction with “Islamic finance” “finance”, “bond”, and “performance”. Besides, “green bond/s”, “investment” “shariah-stock”, “co-movement” were also frequently mentioned in the SRI Sukuk literature. Thus, it signposts, Sukuk is the commonly mentioned words in the literature which was interchangeably used with Islamic finance, green bond, sukuk finance, sukuk investment. Besides, this visualised mapping also indicates Sukuk research was carried out mostly related to explore the performance of Sukuk instruments in Islamic financial investment.

Co-authorship analysis of organisation and country

Co-authorship analysis refers to the interlinkage between organisations, countries, authors in regard to the relatedness of similar research to each other (van Eck and Waltman 2009, 2014). The closer the distance between the map, the stronger the similarly of the published works. Besides, the node size of individual mark indicates the magnitude of impact among the network (van Eck et al. 2010a, 2010b). To explore which institutions and countries have strong working ties in the SRI Sukuk research, we analysed the data using VOSviewer. Results in Fig. 5 a and b demonstrate that Monash University, Australia has the highest strength link weight of 55 among the network with University Melbourne, Australia (52), Bond University, Australia (51), Boston University, USA (51), Harvard University, USA (51), and National University of Singapore, Singapore (51). These six universities have strong ties in regard to doing SRI Sukuk research yet the number of documents published by these universities is similar to the rest of the clusters. Besides, International Islamic University Malaysia (IIUM), Malaysia has a close network with University of Indonesia, Indonesia; The University of New Orleans, USA; Islamic Development Bank; University Sains Islam Malaysia (USIM), Malaysia. Whereas, University Putra Malaysia (UPM), Malaysia; University Technology Mara (UiTM), Malaysia; University Technology Malaysia (UTM); Malaysia, University Tenaga National Malaysia (UNITEN), Malaysia; and INCIEF, Malaysia has a good tie in doing SRI Sukuk research.

a Network between the organisation in doing SRI Sukuk research. (Note: The minimum number of documents published by each institution is set as 3 to make result meaningful). b Network between countries in doing SRI Sukuk research. (Note: The minimum number of documents published by each country is set as 3 to make result meaningful)

Network association among the countries also indicates (Fig. 5b) that although Malaysia contributed the highest number of publications on Sukuk, the collaborative works with other nations is not so many. Precisely international collaboration with Malaysian researchers was mostly from Australia (the closest one, but the name did not appear). Researchers from the United States, Indonesia Saudi Arabia, Pakistan, and Japan had also collaborated with Malaysia, yet the link is not so strong suggesting a sheer number of research has been done with collaboration with local organisations. Hence, collaborative works on SRI Sukuk is not strong yet among the contributory nations, although Malaysia, the United States, Saudi Arabia, Australia, England respectively contributed the highest number of publications since 2000.

Cluster analysis

The results of cluster analysis using bibliometric coupling of documents are depicted in Fig. 6. Due to the introductory stage of SRI Sukuk research, the number of citations of each document is not many in number. Even the total number of citations of the 10th top cited paper is 12 (refer to Table 3). Hence by setting up a minimum number of citations of each document as 3, a total of 53 publications were identified which resulted in three clusters. Identified documents are entitled to the author’s last name and the cluster is depicted by an explicit colour. The documents in the resulted cluster were then reviewed and assigned a name of each. As illustrated in Fig. 6, cluster 1 is “Distinctive feature of SRI Sukuk” (red), cluster 2 is “Comparison between SRI Sukuk and traditional bond” (green), and cluster 3 is “Determinants/factors of choosing SRI Sukuk instruments” (blue). Further, Table 4 outlines more details about the taxonomy scheme of the clusters in the SRI Sukuk literature. Precisely, the second column represents the name of the cluster which is termed based on the qualitative interpretation of SKI Sukuk publications by the authors. Among others, the top three publications, cited reference, journals, and organisation within the clusters are also demonstrated. Following discussion is carried out to enlighten the taxonomic scheme of each cluster.

Cluster 1 – the nature SRI Sukuk instruments

As SRI Sukuk research is still at the introductory phase, the highest number of publications were focused on the basic understanding of SRI Sukuk investment. Out of the total 53 documents identified for bibliometric coupling analysis, 19 documents were grouped into this cluster (i.e., cluster 1). Within this cluster, the most prominent publications are Naifar (2016) with the contribution “Dependence structure between sukuk (Islamic bonds) and stock market conditions: An empirical analysis with Archimedean copulas”; Ibrahim (2015) with “Issues in Islamic banking and finance: Islamic banks, Shari’ah-compliant investment and sukuk”; and Maghyereh and Awartani (2016) with “Dynamic transmissions between Sukuk and bond markets”. Using a quantitative approach, Naifar et al. (2016) reported that there is a strong dependency prevails between Islamic bond and stock market investment while the volatility of market structure is considered. Ibrahim (2015) reviewed the Islamic finance literature and synthesized that past literature is more on plotting the difference between Sukuk finance and conventional investment suggesting a widely accepted theoretical foundation is required to define SRI or Islamic Sukuk. Whereas, Maghyereh and Awartani (2016) studied the volatility and return of Sukuk and bonds using quantitative data and revealed that information transmission functions the opposite way for Sukuk and global bond financing. Other research in this cluster [i.e., Aloui et al. (2015c); Aloui et al. 2015d; Kenourgios et al. 2016; Naifar et al. 2016; Sclip et al. 2016] also investigated the nature of Islamic Sukuk instruments in regard to volatility and dependency with traditional bonds.

Bibliometric data analysis also reveals that prominent cited reference in this study area of SRI Sukuk is Wilson (2008) with the publication “Innovation in the structuring of Islamic sukuk securities.” [242]; Miller et al. (2007) with “UK Welcomes the Sukuk - How the UK Finance Bill Should Stimulate Islamic Finance in London, Much to the Delight of the City’s Banks” [172]; and Beck et al. (2013) with “Islamic vs. conventional banking: Business model, efficiency and stability” [126]. Ranked by the co-citation, top three journals in the area of SRI Sukuk are the “International Journal of Islamic and Middle Eastern Finance and Management” [837], “Borsa Istanbul Review” [821], and “Journal of Comparative Economics” [679]. Furthermore, “Universiti Teknologi Mara” [821], “International Centre for Education in Islamic Finance (INCEIF)” [656] and “University of New Orleans” [652] are the prominent university who has contributed the most in this cluster.

Cluster 2 – competitiveness of SRI Sukuk instruments

Another 15 documents were grouped in this cluster based on the bibliometric coupling analysis. Top three publications in this cluster which explored the competitiveness and comparative assessment between SRI Sukuk and traditional bonds are Azmat et al. (2017) with a contribution “The (little) difference that makes all the difference between Islamic and conventional bonds”; Nagano (2016) with “Who issues Sukuk and when?: An analysis of the determinants of Islamic bond issuance”; and Nagano (2017) with “Sukuk issuance and information asymmetry: Why do firms issue sukuk?”. These three publications analyse the competitive performance between Sukuk and conventional bonds. Whereas as other documents such as Abdul Halim et al. (2017), Azmat et al. (2014a), Mohamed et al. (2015), Smaoui and Khawaja (2017) also discussed on the comparative assessment in regard to performance or functionality between SRI Sukuk and conventional bonds. Hence this cluster is defined as the distinctiveness of SRI Sukuk bonds in comparison to traditional bonds.

Co-citation analysis demonstrates that prominent cited references in this cluster are Aloui et al. (2015a) with the document “Co-movement between sharia stocks and sukuk in the GCC markets: A time-frequency analysis” [145]; Aloui et al. (2015b) with “Global factors driving structural changes in the co-movement between sharia stocks and sukuk in the Gulf Cooperation Council countries” [132]; and Cappiello et al. (2006) with “Asymmetric Dynamics in the Correlations of Global Equity and Bond Returns” [103]. Among the source, Pacific-Basin Finance Journal [2831], Journal of International Financial Markets Institutions & Money [1392], and Energy Economics [1018] are the prominent journals which published SRI Sukuk related documents with the theme of this cluster. Besides, it is important to know which institutions contributed more to this area of Sukuk research. Results reveal that Monash University, Australia [793] followed by Universiti Putra Malaysia, Malaysia [455] and Lahore University of Management Sciences, Pakistan [439] are the leading institutions in this area of research.

Cluster 3 – determinants of choosing SRI Sukuk instruments

Only 9 publications were found in this cluster which portrays a theme namely the determinants of selecting SRI Sukuk instruments in investment. Out of these 9 documents, top three distinguished publications are Godlewski et al. (2013) with the contribution “Sukuk vs. conventional bonds: A stock market perspective”; Zulkhibri (2015) with “A synthesis of theoretical and empirical research on sukuk”; and Klein and Weill (2016) with “Why do companies issue sukuk?”. Both Godlewski et al. (2013) and Klein and Weill (2016) investigated the behavioural aspect of investors when deciding investment between Sukuk and conventional bonds. Whereas, Zulkhibri (2015) reviewed Sukuk literature on three aspects – theoretical assumptions, operational issues and impact in the economic development of Sukuk investment in which various issues including determinants of Sukuk bonds are discussed in the section name - operational aspects of Sukuk. For instance, (Warsame and Ireri 2016) investigated the investment decision of Sukuk using the “Theory of planned behaviour (TPB)”. Likewise, (Azmat et al. 2014b), (Oseni and Hassan 2015), (Oseni et al. 2016) also mentioned the similar aspect related Sukuk investment or transaction.

Renowned cited references in this cluster are Godlewski et al. (2013) with the contribution “Sukuk vs. conventional bonds: A stock market perspective” [263]; Alam et al. (2013) with “Are Islamic bonds different from conventional bonds? International evidence from capital market tests” [185]; and Tariq and Dar (2007) with “Risks of Sukuk structures: Implications for resource mobilization” [96]. Besides, “Al Imam Muhammad Ibn Saud Islamic University” [1203], “Drexel University” [1155], and “IPAG Business School” [966] were among the prominent institutions who contributed more on this area of SRI Sukuk research. Every journal also follows some specific theme of publication in contributing knowledge in a certain subject area. Co-citation of source analysis reveals that “International Journal of Financial Studies” [4401], “Journal of Banking & Finance” [4137], and “International Journal of Finance & Economics” [4076] are the leading journals in shaping the knowledge on the determinants of SRI Sukuk investment.

Conclusion and indication for future research

SRI Sukuk market has been experiencing massive growth since 2000 with a global Sukuk outstanding of US$ 434.5 billion in which Malaysia is leading the market with about 50% share at the end of 2018 (Malaysia International Islamic Financial Centre 2019). Operational nature of Green Sukuk or Islamic Sukuk has given widespread acceptance as a financial instrument around the world (Hasan et al. 2019). Due to this fact, research on SRI Sukuk has also gained widespread attention among scholars. Bibliometric data shows (refer to Fig. 2) that the number of publications has increased in recent time compared to five years ago from now. Hence the current study aims at offering a bibliometric overview on SRI Sukuk literature in order to reveal the publication trends, prominent contributors, organisations and countries, visualise the research clusters as well as suggesting the direction for future research.

As SRI Sukuk is one of the niche areas of Finance study, the majority of the research contribution has come from the area of Business, Finance, Economics, and Management. There are many diverse sets of investment opportunity exist in the economy which can be explored by devoting research related to green Sukuk. Precisely in Environmental Science, Chemical Science, Engineering, Green Technology in which development of new products or process could serve the purpose of SRI Sukuk investment should get the priority in doing future research. Hence, cross-disciplinary research is highly commendable to bring up with innovative ideas and suggestions for the policymakers. It will assist them in designing a new product/feature as a practical implication of Islamic Sukuk instrument. Table 5 provides the summary of possible future research area in SRI Sukuk.

Malaysia is the largest Sukuk market around the world which paves the way to conduct extensive research in this context. Data also signposts that the contribution of Malaysia in doing research on SRI Sukuk is eminent. Although there are some other countries such as the USA, Saudi Arabia, Australia, England, France, Pakistan, Indonesia are among the prominent in contributing knowledge on SRI Sukuk instruments development, the collaborative research is more confined within the Malaysian institutions. As reported by S&P Global Ratings (2019), all the regions around the world have an investment in Sukuk instruments, the joint research across the participatory nations is not good in numbers. Figure 5b portrays the current scenario of collaborative research suggesting Malaysia has very few research jointly done with Australia and the USA. Thus, it is highly recommended to conduct research jointly with other nations to explore the structure, feature of Sukuk investment which can be standardised across the country context. With doing so, the Sukuk market would be extended widely all over the world despite having a generic tag as Islamic finance. Further, more journals should come forward to publish a special issue on Sukuk bond/SRI Sukuk which will motivate the researcher to explore this area of Islamic finance.

As indicated in Ibrahim (2015), previous research on Sukuk was susceptible toward establishing the difference between SRI Sukuk and conventional bonds, bibliometric coupling analysis is also aligned with these findings. Precisely this study reports that the highest number of research contribution is devoted toward investigating the functions or nature of SRI Sukuk funds while second highest numbers are found in the analysis the competitive performance of SRI Sukuk compared to conventional bonds. Both of these themes cover a broad area of SRI Sukuk financial performance in comparison to traditional bonds. Thus, it is highly recommended that future research on Sukuk should drive toward exploring a ground of sustainability of Sukuk finance across the world. Due to having a competitive advantage over the traditional bond, future research might try to solve this research question - can Sukuk bonds be a substitute for traditional bonds? Moreover, the practical implications of Sukuk finance at the macroeconomic level is yet to be explored. Ibrahim (2015) also echoed similar issues such as the role of Sukuk in the development of macroeconomics indices including, equal income distribution, equal access to finance, poverty alleviation. More areas also should be explored to identify how Sukuk finance might help in reducing carbon, global warming and environmental pollution, maintaining a green environment, developing sustainable green technology in consumer goods.

Among the three clusters derived from the previous contributions on SRI Sukuk, determinants of Sukuk finance is less explored which require a great deal of future attention. It is important to know which factors are important in choosing Sukuk instruments over conventional bonds. Although few research has tried to contribute, more research should be carried out in exploring motivational, institutional, Sukuk instrument-related factors from both investor and issuer perspective. As, motivational factors (intrinsic and extrinsic) are the key to drive human behaviour (Williams 2014), it would be necessary to investigate the determinants of Sukuk investment behaviour.

Overall, the research on SRI Sukuk is at the beginning phase. Due to a few numbers of research publications and citations of the SRI Sukuk related contributions (refer to Fig. 2), this niche area of finance is still in the infant stage. Based on the bibliometric analysis of SRI Sukuk literature it is observed that Wilson (2008) and Godlewski et al. (2013) laid the foundation of knowledge related to Sukuk finance which is later expanded by other scholars for instance - Naifar, N., Arif, M., Hassan, M. K. However, there are still many important aspects remain unexplored other than primary understanding about financial performance, competitiveness, structure of Sukuk instruments.

Our current endeavour using bibliometric analysis on SRI Sukuk research offers a novel understanding of how knowledge and empirical contributions on Islamic Sukuk finance have evolved so far. With a few numbers of Sukuk publications available in source, the bibliometric analysis of SRI Sukuk research might provide inconclusive findings. Nonetheless, the methodology and bibliometric metrics analysis using VOSviewer followed in this study are scientific and reliable (Fellnhofer 2019; Krauskopf 2018; Mascarenhas et al. 2018). Hence, the current findings in regard to co-authorship, co-occurrence of keywords, and bibliometric coupling analysis along with descriptive statistics of general bibliographic information reveal reliable results in investigating research trend on SRI Sukuk. The review work significantly contribute in the SRI Sukuk literature along with the managerial application. Moreover, sustainable investment, sustainability management practices, corporate social responsibility investment, and environmental investment literature can incorporate with the present study as their motivations are similar. Additionally, the research has a significant contribution to Islamic finance literature. Policymakers and corporate management also consider the research as notable work as the study is expanding SRI Sukuk to invest in socially responsible, environmentally friendly, and social welfare based collaborative investment. The review work vividly stated the research gap and future opportunities in the SRI Sukuk literature that explore research and investment in academia to investors. It is believed that the research work significantly influences state policy level to corporate management.

Despite significant contribution, this study is not without any limitation. As a bibliometric review the study pointed only three clusters, therefore there is a possibility of missing further important clusters. Lastly, keywords search is not out of controversy as it may ignore some important and time-variant keywords. Future research of bibliometric analysis is also expected in about ten years later with a large number of publications which will provide a convincing research overview on SRI Sukuk. Having this limitation, these findings demonstrate a systematic overview of Sukuk research which paves the way for the scholars and policymakers in doing research and/or taking a decision in future on this area.

Availability of data and materials

Not applicable.

References

Abdul Halim Z, How J, Verhoeven P (2017) Agency costs and corporate sukuk issuance. Pac Basin Financ J 42:83–95. https://doi.org/10.1016/j.pacfin.2016.05.014

Alam N, Hassan MK, Haque MA (2013) Are Islamic bonds different from conventional bonds? International evidence from capital market tests. Borsa Istanbul Rev 13(3):22–29. https://doi.org/10.1016/j.bir.2013.10.006

Alaoui AO, Dewandaru G, Azhar Rosly S, Masih M (2015) Linkages and co-movement between international stock market returns: case of Dow Jones Islamic Dubai financial market index. J Int Financ Mark Inst Money 36:53–70. https://doi.org/10.1016/j.intfin.2014.12.004

Aloui C, Hammoudeh S, Hamida HB (2015a) Co-movement between sharia stocks and sukuk in the GCC markets: a time-frequency analysis. J Int Financ Mark Inst Money 34:69–79. https://doi.org/10.1016/j.intfin.2014.11.003

Aloui C, Hammoudeh S, Hamida HB (2015b) Global factors driving structural changes in the co-movement between sharia stocks and sukuk in the Gulf cooperation council countries. North Am J Econ Fin 31:311–329. https://doi.org/10.1016/j.najef.2014.12.002

Aloui C, Hammoudeh S, Hamida HB (2015d) Price discovery and regime shift behavior in the relationship between sharia stocks and sukuk: a two-state Markov switching analysis. Pac Basin Financ J 34:121–135. https://doi.org/10.1016/j.pacfin.2015.06.004

Ariff M, Iqbal M, Mohamed S (2012) Introduction to Sukuk Islamic debt securities markets. In: Ariff M, Iqbal M, Mohamed S (eds) The Islamic debt market for Sukuk securities: the theory and practice of profit sharing investment. Edward Elgar Publishing, Cheltenham, pp 1–8

Asutay M, Hakim A (2018) Exploring international economic integration through sukuk market connectivity: a network perspective. Res Int Bus Financ 46:77–94. https://doi.org/10.1016/j.ribaf.2017.10.003

Azmat S, Skully M, Brown K (2014a) Issuer's choice of Islamic bond type. Pac Basin Financ J 28:122–135. https://doi.org/10.1016/j.pacfin.2013.08.008

Azmat S, Skully M, Brown K (2014b) The Shariah compliance challenge in Islamic bond markets. Pac Basin Financ J 28:47–57. https://doi.org/10.1016/j.pacfin.2013.11.003

Azmat S, Skully M, Brown K (2017) The (little) difference that makes all the difference between Islamic and conventional bonds. Pac Basin Financ J 42:46–59. https://doi.org/10.1016/j.pacfin.2015.12.010

Beck T, Demirgüç-Kunt A, Merrouche O (2013) Islamic vs. conventional banking: business model, efficiency and stability. J Bank Financ 37(2):433–447. https://doi.org/10.1016/j.jbankfin.2012.09.016

Bennett MS, Iqbal Z (2013) How socially responsible investing can help bridge the gap between Islamic and conventional financial markets. Int J Islam Middle East Financ Manag 6(3):211–225. https://doi.org/10.1108/IMEFM-Aug-2012-0078

Boyack KW, Klavans R (2010) Co-citation analysis, bibliographic coupling, and direct citation: which citation approach represents the research front most accurately? J Am Soc Inf Sci Technol 61(12):2389–2404. https://doi.org/10.1002/asi.21419

Cappiello L, Engle RF, Sheppard K (2006) Asymmetric dynamics in the correlations of global equity and bond returns. J Financ Economet 4(4):537–572. https://doi.org/10.1093/jjfinec/nbl005

De Bakker FGA, Groenewegen P, Den Hond F (2005) A bibliometric analysis of 30 years of research and theory on corporate social responsibility and corporate social performance. Bus Soc 44(3):283–317. https://doi.org/10.1177/0007650305278086

Fellnhofer K (2019) Toward a taxonomy of entrepreneurship education research literature: a bibliometric mapping and visualization. Educ Res Rev 27:28–55. https://doi.org/10.1016/j.edurev.2018.10.002

Global Sustainable Investment Alliance (2019) 2018 global sustainable investment review Retrieved 16 May 2019 http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

Godlewski CJ, Turk-Ariss R, Weill L (2013) Sukuk vs. conventional bonds: a stock market perspective. J Comp Econ 41(3):745–761. https://doi.org/10.1016/j.jce.2013.02.006

Haque C, Buriev B (2017) Who drives whom - sukuk or bond? A new evidence from granger causality and wavelet approach. Rev Financ Econ. https://doi.org/10.1016/j.rfe.2017.09.002

Hasan R, Ahmad AUF, Parveen T (2019) Sukuk risks – a structured review of theoretical research. J Islamic Account Bus Res 10(1):35–49. https://doi.org/10.1108/JIABR-06-2015-0026

Ibrahim MH (2015) Issues in Islamic banking and finance: Islamic banks, Shari’ah-compliant investment and sukuk. Pac Basin Financ J 34:185–191. https://doi.org/10.1016/j.pacfin.2015.06.002

Junkus J, Berry TD (2015) Socially responsible investing: a review of the critical issues. Manag Financ 41(11):1176–1201. https://doi.org/10.1108/MF-12-2014-0307

Kenourgios D, Naifar N, Dimitriou D (2016) Islamic financial markets and global crises: contagion or decoupling? Econ Model 57:36–46. https://doi.org/10.1016/j.econmod.2016.04.014

Khazanah Nasional Berhad (2015) The Khazanah report 2015: venturing into funding innovation and technology, https://www.khazanah.com.my/About-Khazanah/Our-Case-Studies/Khazanah-360/The-Khazanah-Report-2016-Venturing-into-Funding-I?fbclid=IwAR0Sylp9QXBHV1t-Q3QyuXdwOmmvr6Fh_2aP-ohIUK5eDkbJyrf_nKlJIYc. Accessed 16 Dec 2019.

Kim C-S (2019) Can socially responsible investments be compatible with financial performance? A meta-analysis. Asia Pac J Financ Stud 48(1):30–64. https://doi.org/10.1111/ajfs.12244

Klein P-O, Weill L (2016) Why do companies issue sukuk? Rev Financ Econ 31(1):26–33. https://doi.org/10.1016/j.rfe.2016.05.003

Krauskopf E (2018) A bibiliometric analysis of the journal of infection and public health: 2008–2016. J Infect Public Health 11(2):224–229. https://doi.org/10.1016/j.jiph.2017.12.011

Maghyereh AI, Awartani B (2016) Dynamic transmissions between Sukuk and bond markets. Res Int Bus Financ 38:246–261. https://doi.org/10.1016/j.ribaf.2016.04.016

Malaysia International Islamic Financial Centre (2019) Performance of global Sukuk market in 2018 Retrieved 19 June 2019 http://www.mifc.com/index.php?ch=ch_contents_capital_markets&pg=pg_cm_global&ac=27034

Mascarenhas C, Ferreira JJ, Marques C (2018) University–industry cooperation: a systematic literature review and research agenda. Sci Public Policy 45(5):708–718. https://doi.org/10.1093/scipol/scy003

Miller ND, Challoner J, Atta A (2007) UK welcomes the Sukuk - How the UK finance bill should stimulate Islamic finance in London, much to the delight of the City's banks. Int Finan Law Rev 26(5):24–25

Mohamed HH, Masih M, Bacha OI (2015) Why do issuers issue Sukuk or conventional bond? Evidence from Malaysian listed firms using partial adjustment models. Pac Basin Financ J 34:233–252. https://doi.org/10.1016/j.pacfin.2015.02.004

Nagano M (2016) Who issues Sukuk and when?: an analysis of the determinants of Islamic bond issuance. Rev Financ Econ 31(1):45–55. https://doi.org/10.1016/j.rfe.2016.05.002

Nagano M (2017) Sukuk issuance and information asymmetry: why do firms issue sukuk? Pac Basin Financ J 42:142–157. https://doi.org/10.1016/j.pacfin.2016.12.005

Naifar N (2016) Modeling dependence structure between stock market volatility and sukuk yields: a nonlinear study in the case of Saudi Arabia. Borsa Istanbul Rev 16(3):157–166. https://doi.org/10.1016/j.bir.2016.01.005

Naifar N, Hammoudeh S, Al dohaiman MS (2016) Dependence structure between sukuk (Islamic bonds) and stock market conditions: an empirical analysis with Archimedean copulas. J Int Financ Mark Inst Money 44:148–165. https://doi.org/10.1016/j.intfin.2016.05.003

Oseni UA, Ahmad AUF, Hassan MK (2016) The legal implications of ‘Fatwā shopping’ in the Islamic finance industry: problems. Perceptions and Prospects 30(2):107. https://doi.org/10.1163/15730255-12341319

Oseni UA, Hassan MK (2015) Regulating the governing law clauses in Sukuk transactions. J Bank Regul 16(3):220–249. https://doi.org/10.1057/jbr.2014.3

Paltrinieri A, Hassan MK, Bhaoo S, Khan A (2019) A bibliometric review of sukuk literature. Int Rev Eco Finan. In press. https://doi.org/10.1016/j.iref.2019.04.004.

Razak S, (2019) The contracts, structures and pricing mechanisms of sukuk: a critical assessment Borsa Istanbul Review

Reichelt H (2010) Green bonds: a model to mobilise private capital to fund climate change mitigation and adaptation projects. In: The EuroMoney environmental finance handbook. The World Bank, Washington, DC, pp 1–7

Rey-Martí A, Ribeiro-Soriano D, Palacios-Marqués D (2016) A bibliometric analysis of social entrepreneurship. J Bus Res 69(5):1651–1655. https://doi.org/10.1016/j.jbusres.2015.10.033

S&P Global Ratings (2019) Global Sukuk market outlook: another strong performance in 2018? Retrieved 13 June 2019 https://www.spratings.com/documents/20184/86957/Global+Sukuk+Market+Outlook+2018/d1b1aa9b-187f-44c0-8d9c-c1109f5c6890

Sarker MM, Mohd-Any AA, Kamarulzaman Y (2019) Conceptualising consumer-based service brand equity (CBSBE) and direct service experience in the airline sector. J Hosp Tour Manag 38(March 2019):39–48. https://doi.org/10.1016/j.jhtm.2018.11.002

Sclip A, Dreassi A, Miani S, Paltrinieri A (2016) Dynamic correlations and volatility linkages between stocks and sukuk: evidence from international markets. Rev Financ Econ 31(1):34–44. https://doi.org/10.1016/j.rfe.2016.06.005

Securities Commission Malaysia (2017) Guidelines on issuance of corporate bonds and Sukuk to retail investors Retrieved 10 June 2019 https://www.sc.com.my/api/documentms/download.ashx?id=dfc6c5dc-8945-4e40-ac56-9a8ac69bf66f

Smaoui H, Khawaja M (2017) The determinants of Sukuk market development. Emerg Mark Financ Trade 53(7):1501–1518. https://doi.org/10.1080/1540496X.2016.1224175

Tariq AA, Dar H (2007) Risks of Sukuk structures: implications for resource mobilization. Thunderbird Int Bus Rev 49(2):203–223. https://doi.org/10.1002/tie.20140

The Star Online (2015) Khazanah issues RM1b SRI sukuk, https://www.thestar.com.my/business/business-news/2015/05/18/khazanah-issuesrm1b-sri-sukuk/?fbclid=IwAR0yNKTQFbdJ2R1pcTCZE5YaqmDkv-OrFoj2qY8q7jfdlKaoANaCmUQSOOA. Accessed 10 Dec 2019.

van Eck NJ, Waltman L (2009) Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84(2):523–538. https://doi.org/10.1007/s11192-009-0146-3

van Eck NJ, Waltman L (2014) Visualizing bibliometric networks. In: Ding Y, Rousseau R, Wolfram D (eds) Measuring scholarly impact: methods and practice. Springer International Publishing, Cham, pp 285–320

van Eck NJ, Waltman L, Dekker R, van den Berg J (2010a) A comparison of two techniques for bibliometric mapping: multidimensional scaling and VOS. J Am Soc Inf Sci Technol 61(12):2405–2416. https://doi.org/10.1002/asi.21421

van Eck NJ, Waltman L, Noyons ECM, Buter RK (2010b) Automatic term identification for bibliometric mapping. Scientometrics 82(3):581–596. https://doi.org/10.1007/s11192-010-0173-0

Viviers S, Eccles NS (2012) 35 years of socially responsible investing (SRI) research - general trends over time. S Afr J Bus Manag 43(4):1–16

Waltman L, van Eck NJ (2013) A smart local moving algorithm for large-scale modularity-based community detection. Eur Phys J B 86(11):471. https://doi.org/10.1140/epjb/e2013-40829-0

Warsame MH, Ireri EM (2016) Does the theory of planned behaviour (TPB) matter in Sukuk investment decisions? J Behav Exp Financ 12:93–100. https://doi.org/10.1016/j.jbef.2016.10.002

Williams P (2014) Emotions and consumer behavior. J Consum Res 40(5):viii–xi. https://doi.org/10.1086/674429

Wilson R (2008) Innovation in the structuring of Islamic sukuk securities. Humanomics 24(3):170–181. https://doi.org/10.1108/08288660810899340

Zulkhibri M (2015) A synthesis of theoretical and empirical research on sukuk. Borsa Istanbul Rev 15(4):237–248. https://doi.org/10.1016/j.bir.2015.10.001

Acknowledgements

Not applicable.

Funding

We would like to acknowledge the financial support provided by MOHE UM-INCEIF Islamic Finance Research Programme (Project No.MO002–2017).

Author information

Authors and Affiliations

Contributions

MR and MS carried out the empirical studies, the literature review, and drafted the manuscript. CRI and TT helped with the background, data analysis, and discussion. AKM updated the literature review, and communicate with the editor. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Rahman, M., Isa, C.R., Tu, TT. et al. A bibliometric analysis of socially responsible investment sukuk literature. AJSSR 5, 7 (2020). https://doi.org/10.1186/s41180-020-00035-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s41180-020-00035-2